From our experience, Texas has always been a multifamily powerhouse in terms of its demand.

But why does Texas have such high multifamily demand?

TMG’s Jon Krebbs recently spoke with Brandi Smith of REjournals to discuss the multifamily investment market in Dallas, and had this to say:

Texas is a right-to-work state. It has a lower cost of living compared to states such as California or New York. There’s no state income tax. Someone can have a very high quality of life here at a bargain compared to some other markets. As long as there are jobs being created, you’re going to see a lot of activity from apartment developers and a lot of demand from apartment buyers.

And although 2020 had its uncertainties, we were able to find creative ways to help both buyers and sellers find their next deals.

We overcame logistical challenges by using virtual tours, educating buyers about prospects, and preventive measures during inspections and due diligence.

Those items were instrumental in helping close more deals in 2020.

But, besides Dallas, what else in Texas is high in multifamily demand?

San Antonio is a highlight for us because of its steadily growing market and its location in the middle of Texas. Since the rents aren’t high in San Antonio, you can still get a property for about $65,000 a unit. On the other hand, deals in Houston or DFW can go for $90,000 to $100,000 a unit for a Class-C Property.

It’s a substantial difference.

And according to the U.S. Census Bureau, San Antonio is the second fastest growing city in the country.

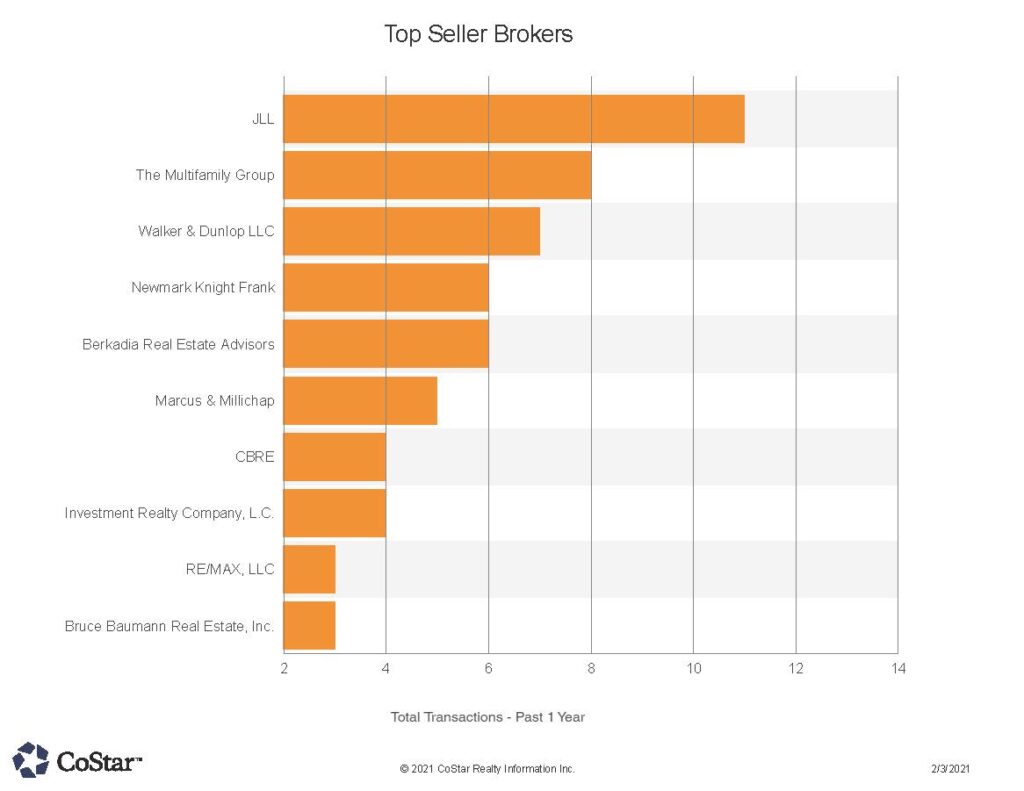

These factors combined, along with our focus on San Antonio are one of the few reasons we are #2 for Top Seller Brokers in San Antonio according to CoStar.

The reality is that when it comes to Texas, we don’t see any headwinds to multifamily investing.

There’s too much job growth for that to be happening.

And with that growth will come more opportunities for both investors and sellers to get results.